Introducing high -dividend stocks in US stocks that have been strong.

In the US market, the stock market is rising due to the low interest rates of Fed monetary easing and the real negative interest rates due to the rise in price, and the NY Dow on July 26, 2021 is the highest ever 35,150..I attached $ 37.The reason why the stock rises when it is a real negative interest rate is that it is easy to borrow money at low interest rates, it is easy to get money, and if you leave the funds as it is, the funds will go to the stock market.Because it will be.

On the other hand, in 2022, due to the possibility of FRB's monetary easing and the sense of high -priced vigilance, many people feel that investing US stocks in a long period of short -term investment in a long term is uneasy.

If you make a long -term investment of US stocks at this level, it is recommended that you make a stable dividend that can be affected by the economy and can receive dividends even if the stock price falls.

A growing US IT companies are currently very high in stocks and often have no dividends.

On the other hand, long -established companies in the United States are high dividends, and many companies have continuously increased dividends.Although it cannot be expected to have a high stock high like IT companies, it is attractive that it can be operated while receiving high dividends for a long time.

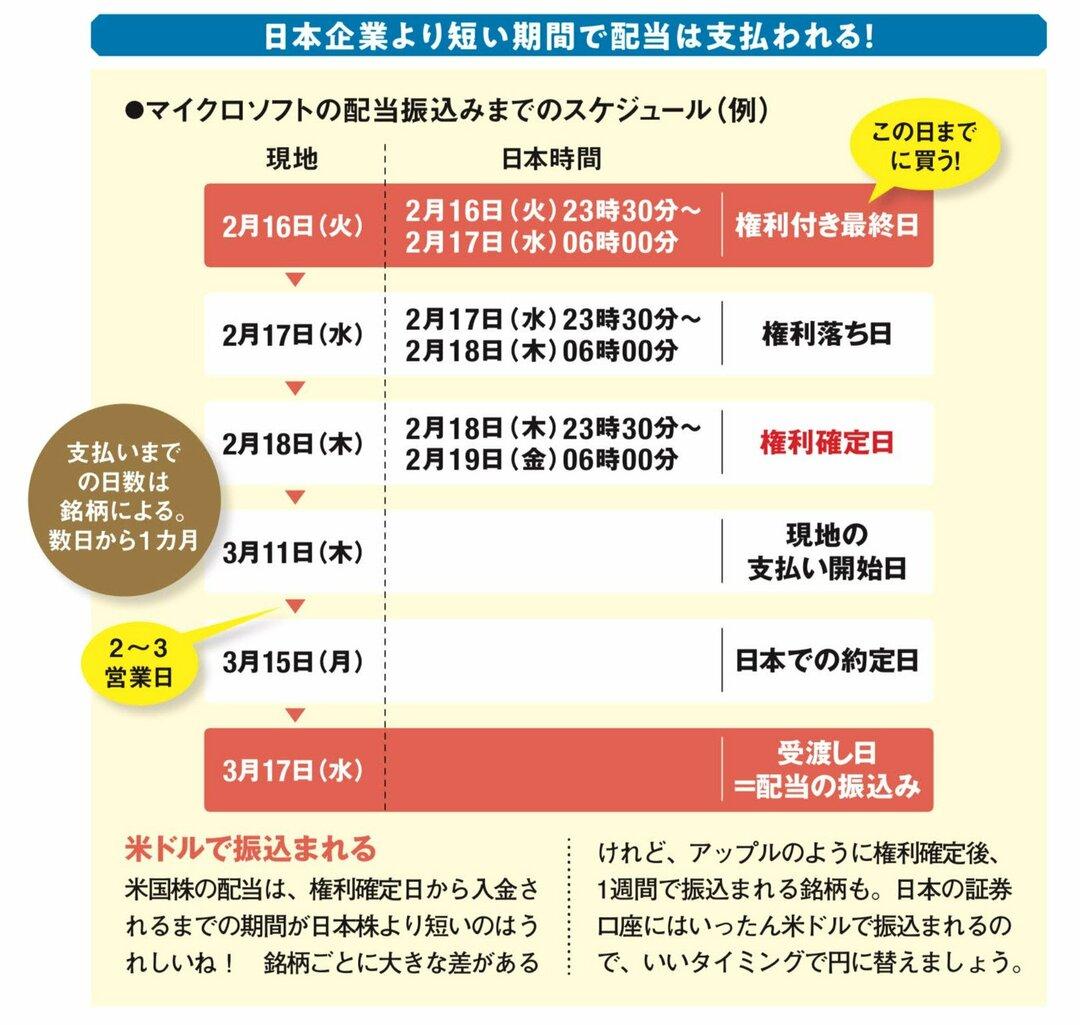

In addition, Japanese stocks are dividends once or twice a year, while US stocks can be received four times a year.

U.S. stocks can be purchased from one share, so it is possible to invest in large companies that are active in the world from around 10,000 to 20,000 yen.

The largest phone call, a telecommunications company, is like a docomo in Japan.It provides wireless, wired communication, video, and broadband services not only for the United States but also for consumers such as Mexico.In the mobile business, which accounts for most of the sales, in 2020, due to the expansion of the new colonavirus infection, the number of prepaid mobile phones (other companies) increased significantly and the sales decreased significantly, but in 2021, postpaid mobile phones again.New contracts have increased and business performance has recovered.In addition, it has integrated Warner and Discovery, which performs movie production and video distribution businesses, and has increased subscription revenue and advertising revenue in opposition to netflix.

The largest mobile phone business, the largest in the United States, can be stable for a dividend of about $ 2 per share per year.

A US pharmaceutical company well known in Japan with the new colona vaccine.

Pharmaceutical companies are ranked second in the world, mainly prescription drugs and vaccines.

The spin -off was held in November 2020, and although the stock price dropped temporarily, stock prices have been increasing so far.Spin -off means that the company's stock price is reduced by separating and becoming independent of a consolidated company.

The sales of the new Corona vaccine will contribute to sales, and vaccine production is likely to increase in the future due to collaboration and expansion.

Bio pharmaceutical company based in San Francisco.It will be the world's second largest bio -pharmaceutical company.Bio -pharmaceuticals are pharmaceuticals, not pharmaceuticals due to conventional value reactions, but as the center of genetically modified and cell fusion.

In 2021, the sales of the antiviral drug "Remdeceville" for the new colonavirus infections have increased significantly, but other drug sales have decreased.As shown in the new coloner treatments and vaccines, biopharmaceuticals are likely to increase from conventional chemical reactions.

Exploration, production, and sales of crude oil and natural gas.In 2020, due to the expansion of the new colonavirus infections, the price of crude oil prices was temporarily reduced due to the decline in demand, and the price of crude oil prices returned to the price of crude oil prices.Most recently, stock prices are not expected because carbonbon is shouting due to the possibility of increasing production and the transportation that emphasizes ESG (environment, society, and corporate rule).Directors who emphasize ESG were appointed by the recommendation of the "Shareholder to Speak", but it is doubtful whether the profit will increase by asking for a petroleum company, and it is difficult to judge whether the stock price will rise in the future.However, it is attractive that economic activity is becoming normal from areas with a high new colona vaccination rate, oil demand has grown, sales are growing, and dividend yields are very high.

IT companies that handle cloud, software and systems.

In 2021, sales were steadily flowing due to the growing cloud business.

IT companies are long -established companies established in 1911 before Microsoft and are the average of Dow 30 types.

Sales of the Lenovo business decreased, but it has escaped from businesses such as PCs, servers, and printers with a long -time low -profit rate, and has been in a hurry to shift to a high -profit business.The growth of the cloud business may mean that this strategy is successful.

However, in the cloud business, Microsoft and Amazon have cut their predecessors, and how much IBM can be extended in the future, and there are many competitions.

(The dividend yield is calculated at the closing price on July 27, 2021, based on the expected dividend, and is converted to 1 dollar = 110 yen).

US stocks are doubled by taxes on site and taxes in Japan.In the United States, dividends are 10%tax and withholding, and dividends in Japan are 20..It is 315%withholding.This double tax is refunded by 10 % of the dividend, which is double as a "foreign tax deduction", by filing a final tax return.By the way, the gain of selling US stocks is not levied locally, so 20 in Japan.It is not doubled because it is only 315%taxable.

In order to receive a foreign tax deduction, a final tax return is required, but (general) investment in the NISA account is not imposed in Japan, so there is no need to file a final tax return.

(General) The NISA account is a domestic sales gain and dividends 20.An account that is tax -exempt with 315%tax. If investing in a US stock in a NISA account, the taxation relationship will be terminated only with 10%withholding of 10%of local dividends, and the domestic division will be tax -exempt and no tax return is required.。

Since there are a limited number of securities companies that can invest US stock investment in the NISA account, it is better to open a NISA account after confirming in advance.

"I want to get married, but if I don't ...?" "I want to enjoy a single life, but in the future ..." "If I break up with my current husband ..."。I don't know what will happen to the future because the times change.However, if you are prepared, you will not worry.Why don't you proceed steadily from what you can do now for the future?Click here for details

Sentence / Takako Okobori is good at Manager's articles as a free writer.She is a representative of Ohori FP Office, CFP certified, and Foreign Securities Foreign Affairs.